Shandong province has one of the highest wind and solar installed capacities in China. It is also a very interesting case study, as it has high local power demand and power generation capacity, with a sophisticated power market. Attempts to reform Shandong’s power market, whether successful or not, can provide lessons to better anticipate the development of China’s power market as a whole. Recently the Shandong Energy Bureau issued a consultative draft of the 2023 Work Plan for Shandong Power Market Trading. Let’s take a glimpse at the most important changes to come:

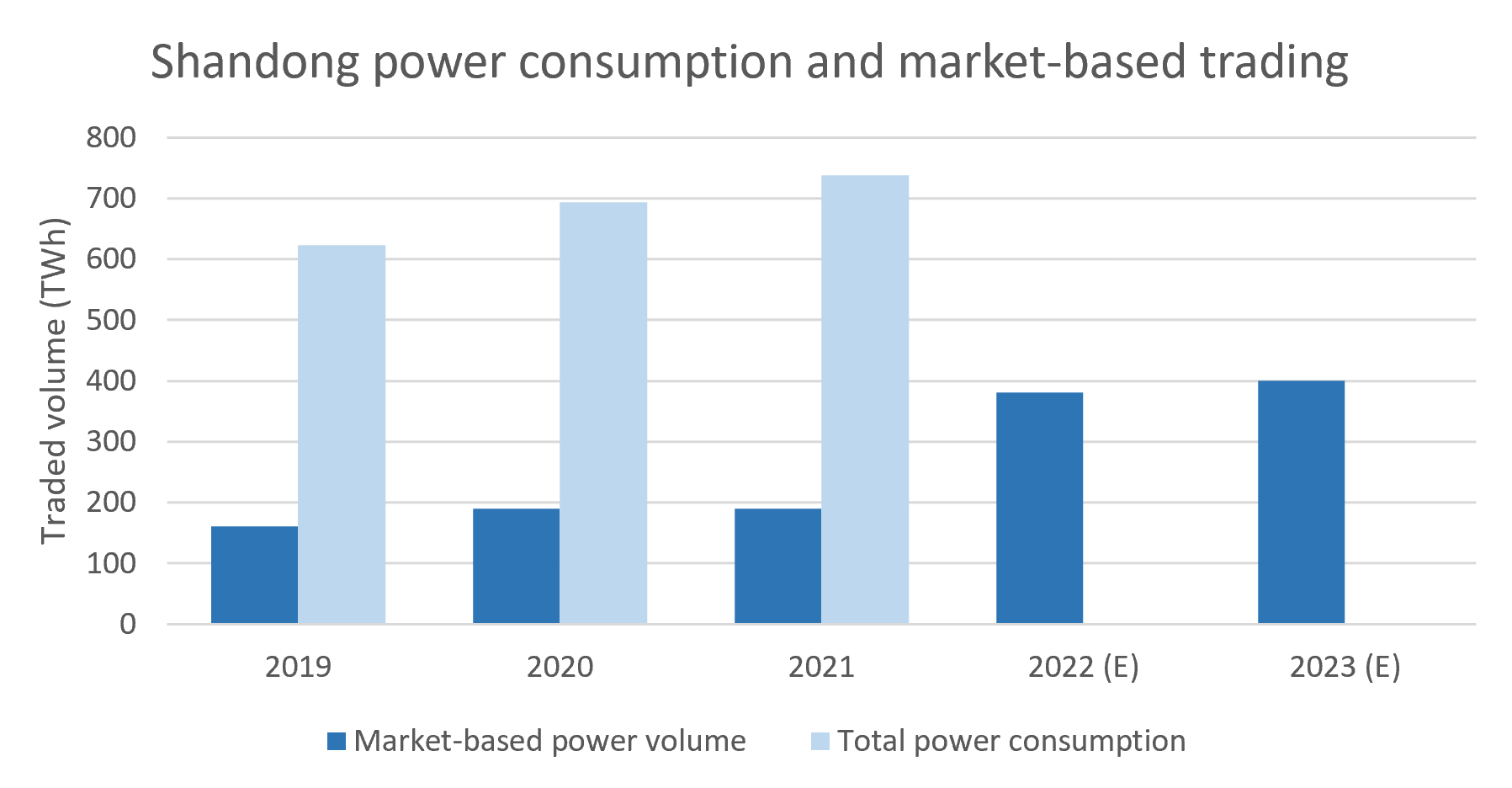

1. Market-based power trading volumes will further increase to 400TWh

In principle, all commercial and industrial (C&I) power users shall participate in direct power market trading. The power grid retailing service will still exist in 2023 for those who cannot sign brokerage contracts with power retailing companies.

Compared to 2022, market-based power will slightly increase as many C&I power users who are still buying from the power grid will switch to market-based trading. In parallel, starting from 2023, all C&I power that would be still retailed by the grid company (excluding the power for agricultural and residential users) will be sourced from the power market.

Figure 1: Market-based power trading volumes are expected to almost double between 2022 and 2021. Expected volumes for 2023 should only slightly increase as most sizable C&I users are already in the market.

2. Transactions shall be more transparent and merit-order based

The government aims to bring mid-long term (forward) contract volumes to represent 80% of market participants’ total power consumption. While annual contracts were unavailable in 2022, they will be introduced next year to enable power users and generators to hedge price risks. The biggest breakthrough unique to Shandong is that centralized bidding for annual contracts will be organized prior to bilateral-negotiation trading. This will introduce fairer competition and transparency for annual contract trading. Indeed, SOE-owned power retailers tended to secure power from power generators under the same parent companies via bilateral negotiation before centralized bidding rounds.

Figure 2: In 2022, bilateral negotiation transactions are organized prior to other types of transactions in Shandong’s monthly trading.

3. Power pricing mechanism: a more market-based demand-side TOU (Time of Use) scheme for peak regulation

First, new capacity compensation tariffs will vary depending on system balancing needs. When renewable penetration is high and power generation can fulfil power demand, capacity compensation tariffs will be set in a 0-49.55CNY/MWh range. However, tariffs will spike up to 149-198CNY/MWh during high peak load hours when the grid’s power balance is threatened.

Furthermore, C&I clients who still buy power from the power grid company will be exposed to more price fluctuations despite staying in the grid company’s “cocoon”. The heavily regulated time of use (TOU) pricing mechanism will be replaced with a more liberalized system that should effectively reflect the real-time balance of power generation and demand.

At the same time, the T&D tariff charged to power grid company clients included a separate TOU pricing mechanism. In 2023, the TOU pricing included in the T&D tariff will be removed and become identical to that of power traded on the market. This new rule should drive more C&I clients currently trading with the power grid company to switch to the market.

4. All new energy power except distributed solar will participate in power market trading but will be subject to different market-based volume (10% – 100% of annual energy production)

New energy projects are encouraged to participate in power market trading. For those who decide to trade in the forward market, 50%-100% of AEP (annual energy production) would be fully sold to the market. As for those who decide not to participate in the market (including subsidized and unsubsidized projects), 10% of AEP needs to be sold in the spot market.

The green premium associated to green power trading and Green Electricity Certificates (GEC) will be used to incentivize new energy projects to actively participate in market trading.

The document stipulates that distributed new energy projects shall bear and share the ancillary service costs. This may be good news for local utility scale renewable projects as it could lighten the costs they currently have to bear. Indeed, distributed solar represented almost 40% of Shandong’s total wind and solar capacity in 2021.

Figure 3: Shandong wind and solar installed capacity forecast in 2025. Distributed solar represented almost 40% of the total wind and solar capacity in 2021.

Source: Azure, NEA, Shandong DRC

It is expected that ~20GW and ~4GW of grid parity (unsubsidized) utility-scale solar and wind projects will complete grid connection in 2023. It is likely that these new energy projects will be able to monetize the green premium obtained via green power trading or the GEC market. Although it is still unclear how many will choose to participate in market trading, the incremental projects could bring in a significant number of new market players. In such a scenario, will the price of green power maintain its ascending trend?

Figure 4: Almost half the solar capacity in Shandong will be subsidy-free in 2023, including a large chunk of distributed solar that is not yet required to sell to the power market.

Source: Azure, Shandong DRC,

At the same time, it is expected that the spot market will be further impacted by increased participation of renewables. New energy project developers will need to pay further attention to power curve definition when signing forward contracts, given renewable intermittency and challenges to provide accurate generation forecasts.

(BJX)