The news concerning the trial operation of the Southern Region Power Market has gained great traction lately. It was reported by CCTV that, on its launch day, over 157 power generators and users traded 2.7 TWh on the interprovincial power spot market. Does it mean that power users in Guangdong can directly buy green power generated in Yunnan on the spot market? What is the implication of such a unified regional power market on power generators and users?

What is a unified Southern Region Power Market?

The Southern Region Power Market includes an interprovincial mid-long-term (forward) market, a spot market, and an ancillary services market. Its goal is to promote the construction of a multi-level and unified power market system, through unified planning, rules and regulations, platforms, and standards.

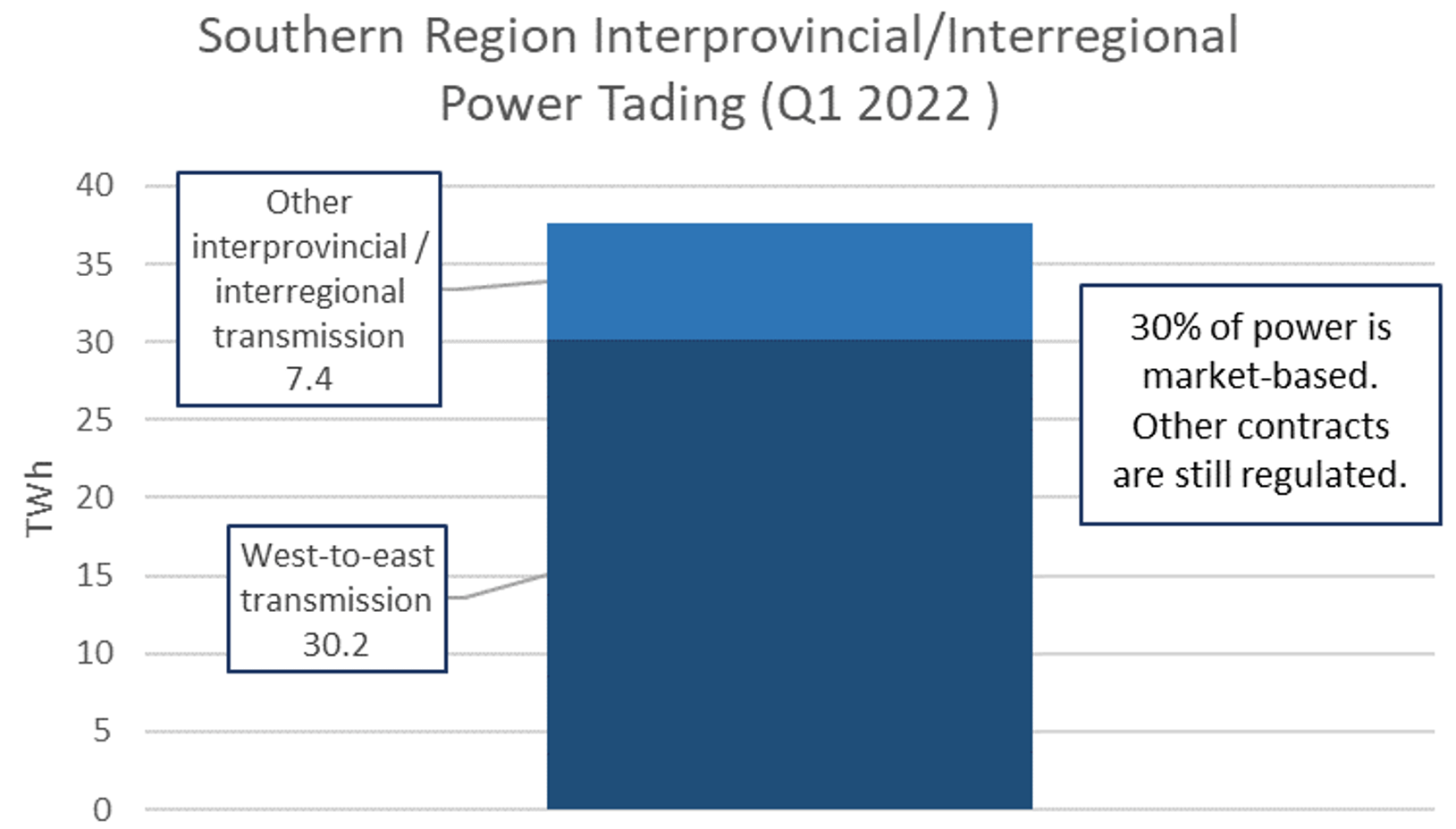

Before the launch, actors could trade nine types of contracts in the southern region, such as annual agreements (e.g. protocol electricity trading), annual incremental electricity trading, or monthly incremental electricity trading. From January to March 2022, 37.6 TWh of inter-regional and inter-provincial electricity transactions were concluded in the southern region, of which 12 TWh were market-based. The previous market-based power transaction system lacked flexibility. MLT (mid- long-term trading) only occurred one or twice a month, which made it impossible for the power load to respond efficiently to power generation changes caused by the intermittency of renewables in the west.

Definition: Protocol vs. incremental power trading Protocol electricity trading refers to the electricity traded under the national power transmission plan and local government framework agreements. Incremental electricity trading refers to the additional electricity traded outside the governmental agreements, taking advantage of the remaining capacity of interprovincial transmission channels to increase the amount of traded electricity.

Some important indications from the new rules of the Southern Region Power Market

The actual impacts on the power market will soon emerge as more details concerning the operational implementation are revealed. Up to now, the Guangzhou Power Exchange (GPX) in charge of the southern region interprovincial power trading has released several documents including:

- the Southern Region Power Market Operation Rules (consultative draft) (Operation Rules),

- the Southern Region Interprovincial Power Market Mid-long-term Trading Rules (MLT Rules), and

- the Method to Settle the Power Deviation of Interprovincial Power in the Southern Region Spot Market (consultative draft) (Deviation Rules).

Several important messages are worthy of attention:

Will the new launch of the unified power market enable more interprovincial direct trading between power users and generators?

The MLT Rules stipulate that electricity trading comprises protocol and incremental electricity trading. The protocol electricity trading is conducted by the provincial grid companies who sign power out-sending contracts on behalf of local governments. The incremental electricity trading is available for the participation of the power users or power retailers.

It is safe to assume that protocol electricity trading under governmental agreement frameworks is always prioritized in interprovincial transmission channels. Market-based power users/retailers can sign direct contracts with power generation companies using the residual capacity of the transmission channels.

Since the trial launch of interprovincial MLT in 2018, part of the protocol electricity regulated in interprovincial government agreement frameworks has turned market based. However, the market-based transactions are mainly conducted among provincial gridcos or gridcos with power generation capacity. The first “point-to-point” interprovincial direct trading between a power generator and user took place in April 2021. One year later, Guangzhou Power Exchange organized the first “power-to-power retailer” interprovincial power trading between Hainan and Guangdong.

Marketization of protocol power trading

The Operation Rules specify that protocol electricity trading is subject to the transaction rules of MLT (mid- long-term trading), like market-based power generation. “When the power supply is secured, the interprovincial prioritized power generation will be liberalized according to the national requirements.” This shows a trend that part of the protocol power generation controlled by governments and grid companies could be extended to other market participants. The transaction prices and quantities would then become more flexible and competitive.

Collective clearing of provincial and interprovincial spot markets

According to the Operation Rules, Guangzhou Power Exchange, the market operator of the interprovincial power market, will coordinate with the five provincial power exchanges, the market operators of the provincial power markets, to organize day-ahead and intraday spot market trading in the southern region. After considering the load forecast, T&D availability, interprovincial protocol power generation, clean energy consumption priority, and other factors, the power exchanges will conduct optimization clearing calculations based on the SCUC (Security-Constrained Unit Commitment) and SCED (Security-Constrained Economic Dispatch) for the interprovincial and provincial spot markets collectively.

It is still unclear how spot market trading will be organized and how these two layers of spot markets will interact. Although Guangdong is already undertaking continuous spot market trading for the entire market-based power in the province, the other provinces in the southern region have barely started to build up their own power spot markets. It needs to be clarified if the other provinces will fully join the interprovincial spot market, including power consumed locally, or just trade power transmitted through interprovincial lines.

According to news released by GPX, other provinces including Yunnan, Guizhou, Guangxi, and Hainan will gradually merge into the interprovincial power spot market. By 2023, a unified trading platform integrating provincial and interprovincial power trading will take shape to conduct more diversified and more frequent interprovincial and interregional power trading transactions.

Power deviation settlement for the interprovincial power

According to the Deviation Rules, different settlement methods will be adopted for different types of interprovincial power. For the market-based interprovincial contracts excluding protocol electricity, deviation between the transaction plan and the actual delivery will be settled on an hourly basis at the real-time price. Specific deviation costs to be borne by the power sending entity (i.e. power seller) equals to the real-time nodal price in the landing point, deducting power losses, provincial and interprovincial T&D fees and regulated costs, if any. As for the interprovincial contracts including protocol electricity, the deviation will be settled in accordance with the MLT Rules, which are based on the pre-agreed and regulated terms and conditions.

One of the key purposes of establishing a regional power market is to optimize the consumption of the intermittent renewable energy in the southern region via a market-based approach. However, historical constraints such as the interprovincial protocol power generation under governmental agreement frameworks may be one of the biggest hurdles to fully take advantage of market mechanisms. On the other hand, easier access to interprovincial power trading may also pose threats to local power generation units. It is imperative to balance the benefits and interests of local and interprovincial power market players as local power generation units will remain the building blocks of local power grid security and flexibility. Finally, a fully connected regional power market with increasingly higher renewable penetration will require a well-functioning interprovincial power ancillary services market that itself necessitates not only technical infrastructure, but also well-developed market mechanisms.