In the first half of 2022, distributed solar accounted for 64% of new incremental capacity of solar power in China. The total capacity of distributed solar reached 126.78GW, representing 38% of the total solar capacity. In this context, the intermittence of distributed renewables is becoming a concern for local grid companies and governments. Provincial and municipal governments in Hebei, Shandong, Zhejiang, and Jiangsu have started imposing energy storage systems (ESS) bundling requirements for newly invested rooftop solar projects, while ESS is already a standard requirement for new utility-scale renewable projects. Unlike utility-scale projects, rooftop solar projects have more options thanks to their direct link to power users.

The most common business models for historical C&I (Commercial & Industrial) rooftop solar include:

- 100% grid-sale

- Self-consumed + remainder grid-sale

- 100% self-consumed

As the grid-sale power is off taken by grid companies at the local coal-fired base price, the local coal-base prices and utilization hours across provinces can cause big income gaps. In the era of renewable grid-parity, C&I rooftop solar investors will need to readjust their business models to maximize their profitability.

Due to the recent spike of power prices, the value of rooftop solar power is escalated

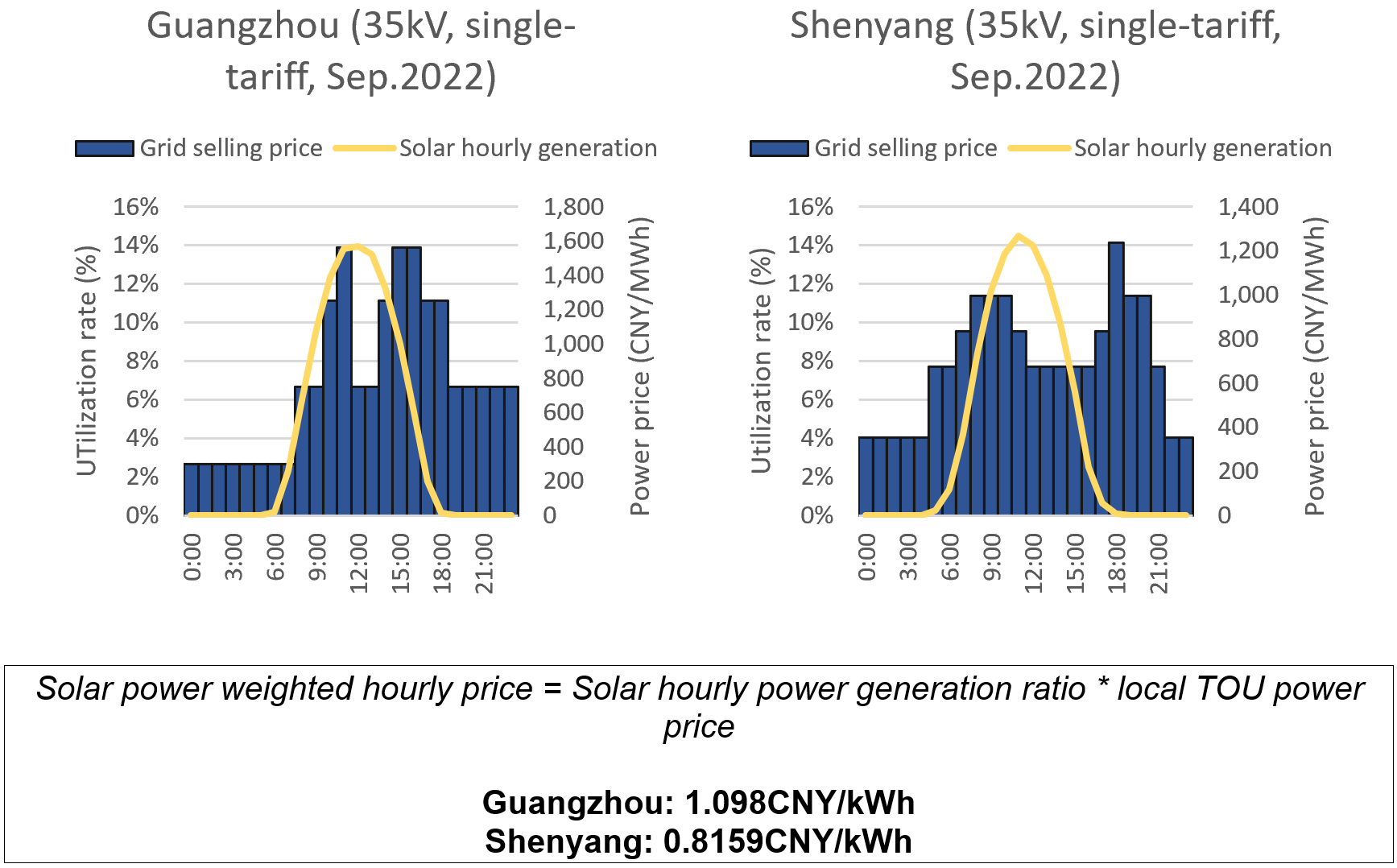

According to the latest grid company power retail prices for September released by the State Grid Corporation of China (SGCC), more than 21 provinces and regions have time-of-use (TOU) gaps larger than 0.7CNY/kWh. Guangdong, Shenzhen, and Shanghai have the most significant gaps, reaching 1.178CNY/kWh, 1.163 CNY/kWh, and 1.397CNY/kWh, respectively.

As a result, the weighted average value of solar power has escalated in provinces with different levels of solar resources, such as Guangdong with a 13% capacity factor or Liaoning with one of 14.4%.

Would shifting a portion of grid sales to self-consumption make sense?

This is a complicated issue. There are several key elements that need to be considered in the new business model design, such as power user’s load curve, ESCO (Energy Service Company) terms (if any), etc. At the same time, characteristics of different provinces may be determinant too.

Let’s illustrate this with a dummy example of a rooftop solar project producing 10 MWh annually: 70% of power generation is consumed by the factory who owns the rooftop, the remaining 30% is sold to the local grid company at the local coal-fired base price. The rooftop solar investor is considering shifting the grid-sale portion to self-consumption to monetize the TOU gaps. Supposing the power user could consume all the remaining power at peak hours, let’s compare the scenarios in Guangdong and Liaoning respectively, with all other things being equal (i.e. CAPEX and OPEX, power user’s load demand, and other elements are the same) and TOU price arbitrage is optimized.

As illustrated below, income from the sale of the remaining power could grow by 178% in Guangdong and 136% in Liaoning due to the high TOU gaps.

Does it still make sense to store the grid-sale portion for TOU arbitrage if peak demand and supply don’t match?

If power users’ load doesn’t match the solar project’s power production curve, they might not be able to fully consume the power generated by the said solar project. In such a case, investors may need ESS to store the power surplus so it can be used at peak hours. In this case, the solar levelized cost of electricity (LCOE) would need to compete with the local power valley price.

(Given 4.6CNY/W as the reference price for CAPEX, 6.5% as the discount factor, solar PV LCOE reaches ~0.45CNY/kWh and ~0.40CNY/kWh in Guangdong and Liaoning, respectively. Levelized cost of storage (LCOS) ceiling refers to the maximum LCOS below which the ESS cost needs to be controlled in order to remain attractive vs. TOU prices).

The table above describes the results of a simple model considering two different options: (1) ESS + charging from PV; (2) ESS + charging from grid, with the objective of maximizing TOU arbitrage revenues. Considering the highest available TOU arbitrage in Guangdong (critical peak/valley gap), ESS can reach the minimum economic return threshold sooner than Liaoning, with lower requirements on LCOS. In both provinces, as valley prices (0.3020CNY/kWh in Guangdong and 0.3550CNY/kWh in Liaoning) are much lower than solar LCOEs (0.45CNY/kWh in Guangdong and 0.40CNY/kWh in Liaoning), using solar PV for power charging may be less competitive than power from the grid at valley hours.

Nevertheless, projects have different characteristics and the 30 provinces across China have distinctive conditions. Here are only a few examples showing that bundling solar and ESS may not be the most profitable. But solar + ESS bundling will become increasingly critical as renewable energy penetration rises.

Other business models to create revenues for power user side ESS exist

The evolving power market is enabling a lot more diversified business model for ESS applications, such as Demand Side Response (DSR), peak regulation services through integration of Virtual Power Plants (VPP – certain provinces allow VPP to participate in the peak regulation market), backup power to prevent power crunches, etc.

For instance, the Guangdong DSR implementation plan issued in April this year allows a bidding ceiling of 3500CNY/MWh for the D-1 DSR (day-ahead DSR auction arrangement), and the price for interrupted load demand can reach up to 5000CNY/MWh. Last year, Sinopec Guangzhou earned over CNY 8 million (USD 1.15 million) for 62 hours of DSR services.

Some provincial governments such as Hebei have begun encouraging distributed renewable projects to lease and share the use of independent ESS, which could become a trend in the future. Independent ESS, which is usually at a larger scale, have more flexibility and options to venture in the ancillary services and power spot markets. Shandong has lately issued the first provincial policy to promote independent ESS participation in the power spot market. In addition to a waiver of T&D fees for charging from the grid, the independent ESS of demo projects can also enjoy capacity compensation fees twice that of normal power generators in the power market, which is almost 0.2CNY/kWh!