A record bid price confounding industry experts

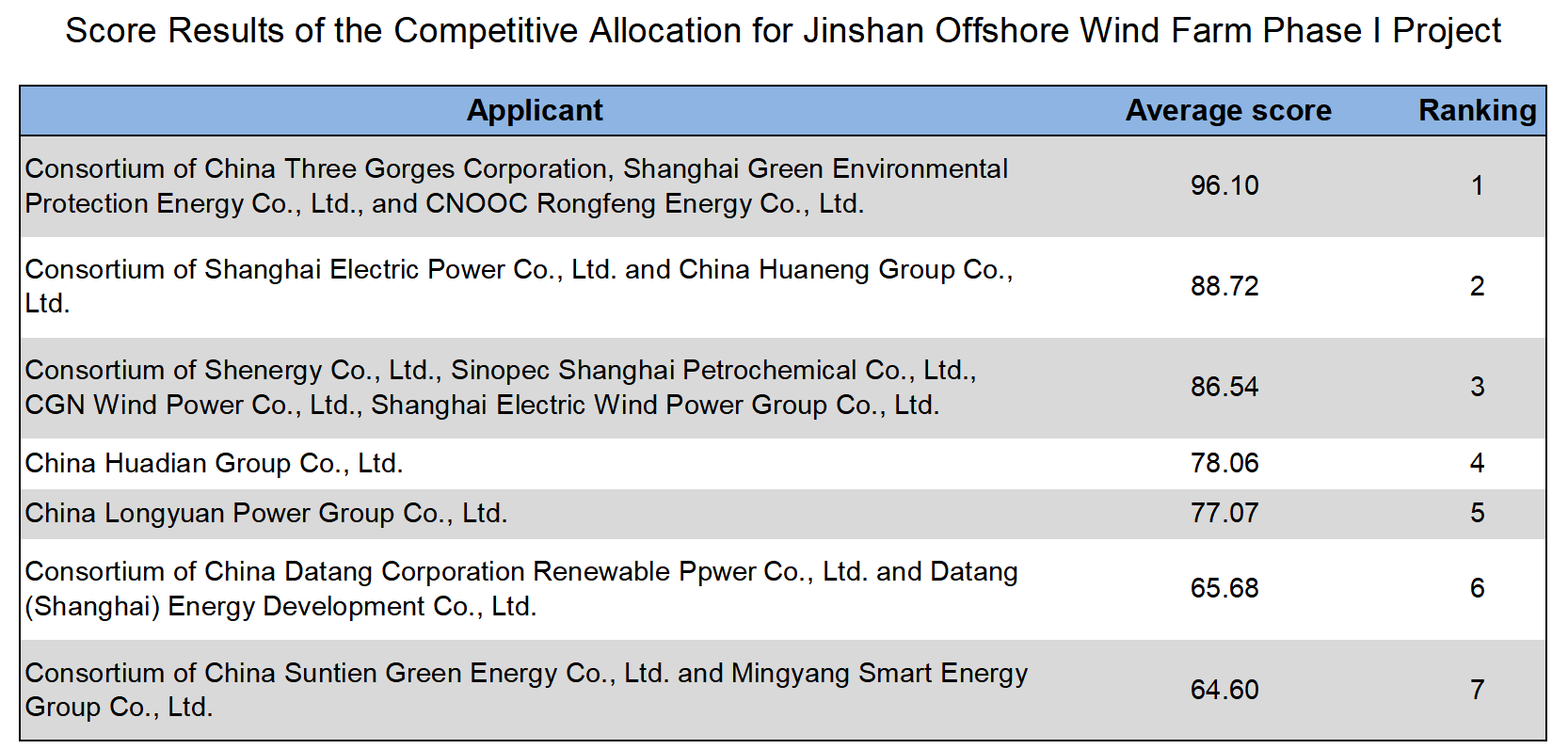

Amid one of China’s most severe COVID lockdowns, the Shanghai Development and Reform Commission (DRC) announced the official winner of the Shanghai Jinshan Offshore Wind Phase 1 Project. The consortium composed of China Three Gorges, Shanghai Green Environmental Protection Energy Company, and CNOOC Rongfeng Energy, was awarded the development rights for the 300 MW project. The consortium won the bid with the lowest on-grid price of 0.302CNY/kWh, or 0.1135CNY/kWh (27 %) lower than the Shanghai coal-fired base price.

Such a low bid price has astounded the Chinese offshore wind industry, as projects in other provinces are still struggling to achieve grid-parity. Many industrial experts are racking their brain to understand how an offshore wind project with such a price can be economically viable. Could this be achieved with high utilization hours due to the better wind resources, combined with low costs via synergies between consortium members, or low turbine procurement costs, etc.? Most likely, this record bid price can be mainly attributed to the technological progress and supply chain development together with reduced profit expectations for suppliers and developers driven by intense competition. However, another factor could be at play. Could the latest developments of China’s green power market have impacted the bid price?

Shanghai’s power market is still at its early stages but promises to be attractive

In the Jinshan offshore wind competitive allocation scheme policy released by Shanghai, a particular rule concerning on-grid pricing differs from other provinces: ‘The project can participate in power market trading upon completion. Before the project participates in the power market, the power will be purchased by State Grid Shanghai at the bid on-grid price. Green attributes will be kept by the Shanghai government. If the project participates in the power market trading, off-take price will be market-based and the green attributes will belong to the developer.’

Shanghai’s power market has several remarkable characteristics:

- Shanghai’s power trading market is much less developed than the other major provinces. Shanghai DRC released the Shanghai Power Market Overall Construction Plan 《上海电力市场建设总体方案》at the end of 2020 and launched its own power market in 2021. Renewable energy including offshore wind is and will be allowed to trade in the power market very soon.

- Shanghai is highly dependent on power imports from China’s western provinces. Imported electricity, 60% of which is hydropower, accounts for about 47% of local power consumption. Local power generation can support only half of the local power demand.

- Local non-hydro renewable power accounted for 8% of the total generation capacity in 2020. Shanghai’s current non-hydro renewable portfolio standard (RPS) is around 4%, which means 4% of the local power demand comes from wind, solar, and biomass. Considering local resource limitations and the uncertainty of imported new energy power, Shanghai will feel the pressure to meet its 2030 non-hydro incentive target of 17.7%.

- Shanghai is the first destination of many multi-national companies who have set a timeline to meet net-zero. Green electricity is in high demand and power users are more open to the idea of signing a 10-year or even 20-year corporate PPA.

The consortium could be eyeing profitable returns on the green power market

The price bid by the consortium is thus the price it expects to sell to the grid. However, once it is eligible to sell its power on the market, it will receive a market-based price and the corresponding green attributes as formulated in the rule above. The project is expected to be grid connected by the end of 2023. As green power is anticipated to be in high demand in Shanghai, the price bid by the consortium could represent a bet that they will be able to participate in the power market soon enough and that prices will be attractive enough to make the project profitable.

The true story behind the bidding results has yet to be discovered. But adopting a well-designed commercial model based on the latest market mechanisms might be equally effective as reducing LCOE to enhance the IRR of offshore wind projects in China.