Hubei province organized the first green electricity trading for 71 power users in the province for the purchase of 462GWh of green power. All power users have been awarded Green Electricity Transaction Vouchers. These are the first and only certificates certified by both power trading and carbon trading exchanges. Power users can therefore use these vouchers to offset their own CO2 emissions in their reporting in Hubei. It is estimated that Wuhan Iron & Steel Co. will be able to reduce its CO2 emissions by over 20,000 tons through its purchase of 30 GWh of green power.

Why is it a meaningful step to have this voucher recognized jointly by both the power and the carbon emission exchanges?

While the Chinese government has started promoting green electricity consumption, the transaction volume of green electricity traded in the market is still limited. At present, most buyers are multi-national companies with production facilities and supply chains in China. Certainly, this slow take-off of marketized green electricity can be explained by many factors such as supply shortage, inter-provincial transmission, or other regulatory and technological obstacles. However, the lack of integration and mutual recognition between carbon emissions reduction and green power utilization is an equally important cause for the low buying desire of the Chinese emitters. So far, China has not yet issued accounting standards for the carbon reduction contribution of green electricity consumption. In the current CO2 emissions accounting standards issued by the Ministry of Ecology and Environment (MEE) for the 24 key monitored industries, it is still advised to use the regional power grid’s emission factor (EF) to calculate the total carbon emission of all the external power purchase. In other words, the use of green power through corporate PPAs is not recognized in carbon emissions reduction accounting.

Compared to Green Electricity Certificates (GEC) and various other green electricity consumption vouchers issued by other provinces, Hubei has clearly specified the number of tons of CO2 emissions that can be deducted from the power user’s total emissions. In addition, the vouchers have been approved by the carbon emission exchange who is the dedicated authority for CO2 emissions trading.

Why is it so difficult to link green electricity and carbon emissions reduction?

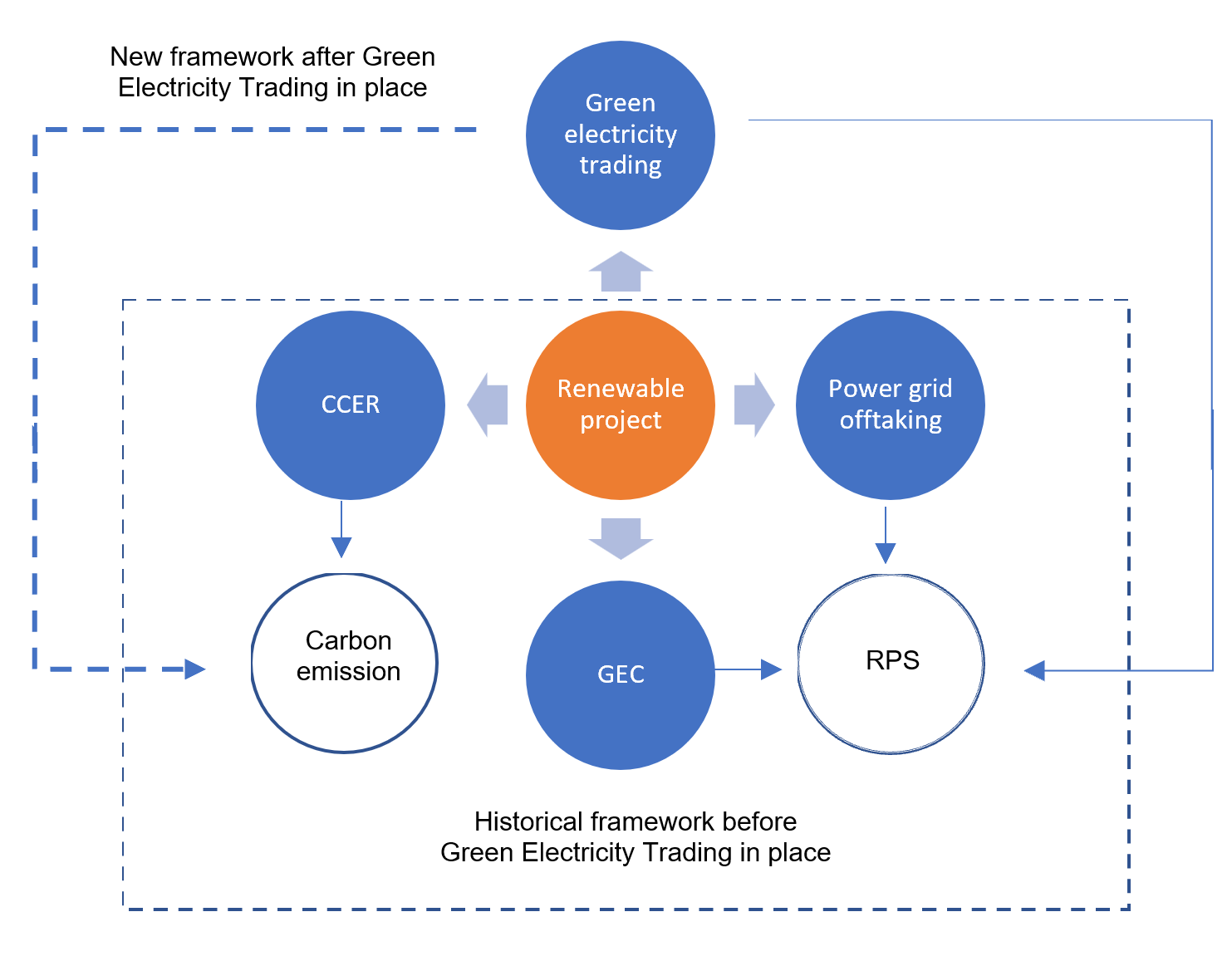

The possibility of double-counting and the lack of information transparency make it difficult to identify the amount of carbon emissions avoided by the consumption of green electricity. So far, renewable power projects have access to several revenue streams: power grid off-taking/market trading, subsidy/GEC/other types of renewable energy certificates, and CCER/CDM/other carbon offset tools. All of these are governed by different mechanisms and regulators. It is thus imperative for the central government’s environmental and energy regulators to coordinate and work out fair rules to properly integrate the environmental value of renewable energy.

Figure 1: Current relationships among different power and carbon mechanisms

Coordination across regulatory departments should help promote green electricity trading

Seven central departments including the NDRC, the Ministry of Industry and Information Technology (MIIT), jointly issued an Implementation Plan to Promote Green Consumption 促进绿色消费实施方案 in Jan.2022. The document encourages to:

“Establish a mechanism for linking green electricity trading with renewable energy consumption responsibility, in which market-based power users complete the renewable energy consumption responsibility through the purchase of green electricity or green certificates. Strengthen the connection of green electricity trading with carbon emission trading. With the help of the revision and improvement of the technical specifications for the carbon accounting reports of relevant industries in the national carbon market, study the feasibility of deducting green electricity-related carbon emissions in emission accounting.”

The growing Chinese national carbon trading market

China has just completed the settlement for its first national compliance cycle of CEAs (Carbon Emission Allowances, the Chinese ETS) for 2021. Over 2000 power companies whose aggregated annual CO2 emissions exceeded 4.5 billion tons, were the first batch of emitters to complete the quota settlement. According to the MEE, the accumulated carbon quota traded during the first compliance cycle reached 179 million tons of CO2 sold at CNY 7.661 billion, or 42.8 CNY / ton on average.

The new established Chinese national carbon trading market is already the largest in the world in terms of total CO2 emissions. According to Mr.Lai Xiaoming, Chairman of Shanghai Environmental Trading Exchange, two more industries will be included in the CEA compliance scope in 2022. With the inclusion of the other key industries during the 14th FYP, the market size could be doubled.

The latest carbon price (Chinese CEA) was 58.8 CNY / ton on April 29th, before the labor holiday, which was already 37% higher than the average price during the first compliance cycle. With higher market demand and tighter control on quota allocations, it is likely that the CEA could further narrow the gap with the price of ETS, its European counterpart.

In principle, green electricity trading and carbon trading are market-based tools to reduce GHG emissions. However, both are under the supervision of two different governing authorities with different political objectives. If the environmental value of green electricity consumption can be properly recognized at a national level in carbon emissions accounting, its trading volumes and prices will reach new highs.

(Xinhua Net, Xinhua, Tonghuashun, NDRC, People Hubei )